Liberal Leader Mark Carney dismissed suggestions he was involved in tax avoidance following a Radio-Canada report about his work at Brookfield Asset Management (BAM).

The outlet reported on Wednesday that Carney co-chaired two investment funds at BAM that were registered in Bermuda, a well-known tax haven for investors. Those funds were worth a total of $25 billion.

Asked about the report at a Windsor campaign stop yesterday, Carney said that the design of the funds was such that Canadian pension funds invested in them reaped benefits and that the beneficiaries then paid taxes on those investments. Pressed on whether it’s ethical to register the funds in Bermuda and why that was done, Carney said it was an “efficiency” method.

“The flow through of the funds go to Canadian entities who then pay the taxes appropriately as opposed to taxes being paid multiple times before they get there,” he said. “It doesn't avoid tax because the tax is paid in Canada.”

But opposition leaders pounced on the report, the latest to scrutinize Carney’s time at BAM.

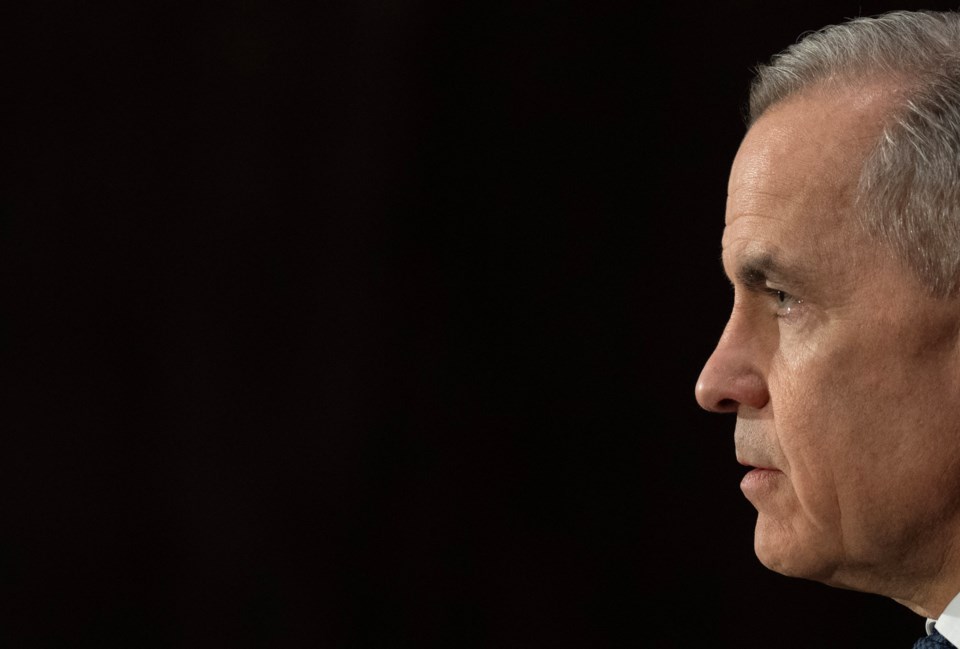

CPC Leader Pierre Poilievre called for more transparency from Carney, arguing he needs to explain why he thinks Canadians should pay taxes but “bigshot bankers” like himself can “dodge” the rules.

“He claims that somehow this money gets funnelled through a Bermuda tax haven only to come back to Canada — well why wouldn't he just leave it in Canada in the first place?” Poilievre told Quebec reporters. “He says he knows how the world works? He knows how to make it work for him and against you, and that is exactly what he will do as prime minister."

Poilievre added that after U.S. President Donald Trump threatened Canada’s economy, he sold his own investments in "foreign economies” and now has investments in Canadian stocks and companies. He did not say which ones.

NDP Leader Jagmeet Singh chided Carney for being “personally responsible” for the Bermuda decision, arguing it was “for the sole reason of avoiding paying taxes.” He said the move means there is less cash for Canada to invest in services for seniors and health care, telling Toronto reporters it makes him “wonder” about who Carney is fighting for.

Bloc Leader Yves-François Blanchet called the use of tax havens “worrisome,” urging Carney to be more forthcoming about his assets and possible conflicts of interest.

“People have to know who that guy is, what he owns and if facing a choice between personal interest and friends’ interest of millions of dollars, will he favour the people in the small families or the friends?” Blanchet told Montreal reporters.

Carney reiterated that he’s “overcomplied” with ethics rules to divest his assets into a blind trust since being sworn into office, dismissing suggestions for more disclosures about his time in the private world.

“What I've done is put all my affairs in order well in advance. I own nothing but cash and personal real estate. That's not going to change in public life. It’s actually quite straightforward," he added.

Pressed on whether that means he won’t receive equity stake, stock options or other payments in the future from fintech company Stripe or BAM, Carney stressed that all other assets are in a blind trust. Carney sat on Stripe’s board but said he has since resigned to enter politics.

Meanwhile, Carney also shut down suggestions from Poilievre that his time at BAM puts him at odds with national interests, given the firm’s ties to China. Poilievre argued that Carney should disclose his conflicts of interest, though the Liberal leader said he is “absolutely not beholden” to anybody but Canadians.

“(Poilievre is) a conspiracy theorist. He spends too much time with his MAGA friends and comes up with everything you can think of. I'm beholden to the Canadian people,” Carney said.

The Liberal leader said Canada has frosty ties with Beijing over its actions in the agriculture and auto sector, appearing to dismiss China’s ambassador to Canada’s suggestions that both countries should deepen trade amid Canada's tiff with the U.S.

“We’ve got to understand where China is, where China is going, whether or not there is any room for partnership in that,” Carney said. While Ottawa needs to diversify its trade and pull away from the U.S., Carney argued it must cozy up to “like-minded” nations in a “deliberate” way.

“There are partners in Asia that we can build deeper ties (with), but the partners in Asia that share our values don't include China,” he added.